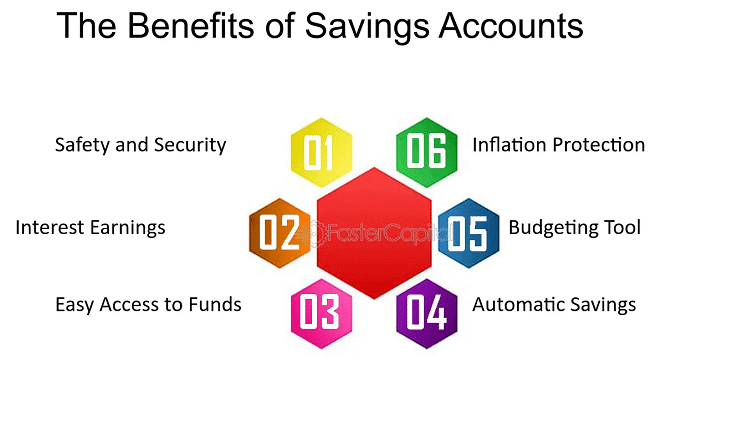

5 Benefits of a High Interest Savings Account for Your Financial Goals

Using the right tool to reach your financial goals can make all the difference. A high-interest savings account is among the most dependable methods to securely increase your money, even if flashy investments and fashionable financial ideas could take the stage. These accounts, which are meant to have more appealing interest rates than regular savings accounts, may be rather important in increasing your financial stability and enabling you to meet both short- and long-term goals.

Earn More on Your Savings

The capacity of a high interest savings account to increase your money’s earning power—without any effort—is among its most clear benefits. Given your balance increases quicker than in a conventional savings account due to the greater interest rate, your return on investment is better. For instance, over a year, you will make $200 in interest if you invest $10,000 into a 2% annual interest high-interest savings account. On a typical savings account at 0.1%, you would only make $10. Although at first glance, this difference seems minor, compound interest over time greatly increases the disparity.

Keep Your Funds Accessible

One often-held belief is that getting more interest locks your money away. Although this might be true for other investment vehicles, including certificates of deposit (CDs), high-interest savings accounts provide the ideal mix between accessibility and growth. These stories are perfect for emergency savings or objectives with flexible deadlines, as they usually let you take money as required. You may easily access your money without penalty, whether your savings are for a down purchase, a planned trip, or unanticipated expenditures. This adaptability helps, especially if you wish to stay out of debt amid a financial crisis. You may use your high-interest savings account instead of credit cards or loans with high rates to still get a competitive return on your balance.

Benefit from Low Risk and Peace of Mind

A high-interest savings account is difficult to surpass if you’re seeking a safe venue for your money to grow. These accounts provide consistent returns, unlike stocks or other assets whose value changes with the state of the market. Usually up to a specific sum, government organizations like the FDIC in the United States or CDIC in Canada insure high-interest savings accounts. This implies that your money is safeguarded even in cases of financial crisis for the bank or other financial establishment. This piece of mind is priceless for those who are risk averse. Knowing that your hard-earned money is safe will let you relax and enjoy the advantages of better rates.

Encourage Consistent Savings Habits

Starting and keeping good savings practices also depends on opening a high-interest savings account. Seeing your balance increase faster inspires you to save more often, therefore transforming financial discipline into a joyful experience. Features like automatic transfers, which let you regularly shift a specific amount of money from your checking account into savings, abound in many high-interest accounts. This “set it and forget it” strategy guarantees that you are regularly advancing your objectives free from the temptation to spend first. Higher-income adds another motivation that might change your perspective. You’ll start seeing savings as a smart approach to make your money work for you rather than as a task.

Perfect for Both Short- and Long-Term Goals

High-interest savings accounts have also shown to be rather flexible. These accounts give a consistent forum for you to increase your money, regardless of the distance— months or years ahead. Short-term objectives like saving for a getaway or a new gadget make the account a natural choice, given its accessibility and development capacity. You will keep your money easily accessible for when you need it and make more on it. A high-interest savings account provides a consistent basis for long-term objectives such as establishing a down payment for a house or making retirement plans. Although it may not yield the same profits as more dangerous investments, it provides a degree of assurance unparalleled that guarantees your money will be there when most needed.

Conclusion

More than just a location to save money, a high-interest savings account is a tool that speeds up your financial development, promotes disciplined behavior, and maintains your cash safe and easily available. Spend some time investigating your choices, weighing rates, and selecting an account that fits your objectives. One deposit at a time, a correct high-interest savings account helps you create a better financial future.